This is part of my Series on Venture Capital.

I see a lot of amazing

things happen when investors and entrepreneurs interact. I’ve witnessed and

been a part of many Venus-Mars moments, the rare love-fest and then of course, what

I call the annual train wreck. Today I’ve chosen three questions that may come

your way that you ought to understand when you’re out raising capital. I chose

these specific questions from the multitude only because I’ve cringed at the responses

I’ve heard so many times.

Q: So, how much money

have you raised or invested in this company?

This question is

actually the least loaded of the three I’ve chosen. It’s very straightforward. On

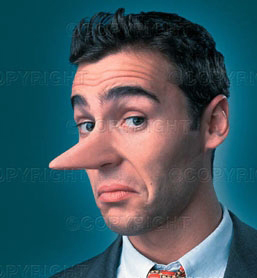

three separate occasions this year, however, I’ve heard the entrepreneur, (who

in each case had raised zero money), throw out a number in response that

roughly corresponded to the non-dilutive grant money the company had received

in the past, prior to his involvement. At least once this number was in excess

of one million dollars and gave the impression of a large seed round of some

kind. Whereas these responses were technically not outright falsehoods, I knew

in each case that there was an intent to ‘slip this one by’.

One thing to keep in

mind here is that the investor really wanted to know two things: 1: Have you

put any of your own money into this company? And 2: Has anyone else put actual

money into this company as an equity investment? If the company, (or the lab

technology pre-company for that matter), received grant money in the past that

is wonderful- but be specific about it. You are building a relationship with a

potential partner after all. First of all it’s the right thing to do. Also, the

investor will certainly find out eventually when he or she sees the cap table.

So be clear and honest in all your answers. An example of an acceptable answer

might be: “The company received some non-dilutive grant money from Gov’t Program

Z one year ago, but no, we have no equity investors as of yet”.

Q: I see, so who else in

the investment community are you speaking with?

Ok, so this is a rather loaded question. Some

entrepreneurs greatly resent it and perhaps with good reason. They know full

well that the VC will be calling any fund they volunteered by name soon after

they depart the building. Georges van Hoegaerden of the Venture Company (www.venturecompany.com) is

particularly critical of this question and others like it and feels that it is

an indicator of what he colorfully terms a “sub-prime VC” and the lemming

mentality he so detests. http://venturecompany.com/opinions/files/detect_subprime_vc.html

But let’s put these

macro issues aside for the moment. Let’s face it- when you ask someone to

invest in your company, you have implicitly submitted yourself to entertaining

questions of all kinds, (no matter how inappropriate). So how should one answer

such a question? Well, here’s some practical advice. Don’t hem and haw and don’t

start out on some long-winded, rambling and evasive story. Be prepared for how

you want to answer this question. If you decide ahead of time that you won’t

answer this, prepare an elegant response. For example, you could say something

like “I’m talking to a number of funds but am really looking for the right

partner who believes in this team and this vision”. If you’re willing to

answer, do so and mention the funds with whom you’ve spoken. How you choose to

respond is largely a matter of taste and personality I think, but the key is to

have conviction, prepare and be forthright. Never hem and haw and

never equivocate.

Q: Got it, so this is

really interesting. What’s the valuation of the company?

Wow. This is the one

question I’ve seen people botch from the most real-deal traditional

conference-room pitch to the most academic ivory-tower business school venture

competitions I’ve moderated or judged. I’ve seen the deer-in-the-headlight look

take hold. I’ve seen presenters repeat the question in a near catatonic state….

“the valuation, the valuation…. well….”. I’ve seen the most confident and

polished presenters suddenly look over helplessly to their partner for

help. Most often, however, people

dissemble, equivocate, punt, smile nervously or giggle out loud in a strange

and guilty manner as if their bluff has been called and the unforeseen moment

of truth has arrived. I’ll leave the “Why” in all this to trained shrinks

although I personally believe it is because presenters simply are not prepared

for this stark, direct question.

So what to do? Again, my

advice is simple. Prepare for this question! If you are confident in the

business, in yourself and the plan you have put forth be ready to calmly state

your pre-money valuation. For example.

“I’m glad you’ve asked. We’re at a pre-money of $X million and look forward to

any other questions you have.” If you’re

not confident enough to set a pre-money valuation, maybe it’s best to ask

yourself why before going out to raise capital.

What I’m trying to convey

is this: Be prepared, be yourself, be honest. You win no matter what this way.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=be20dc8f-7988-41c9-a7e0-f6cc87f9ea23)