This is part of my Series on Venture Capital and Angel Investing.

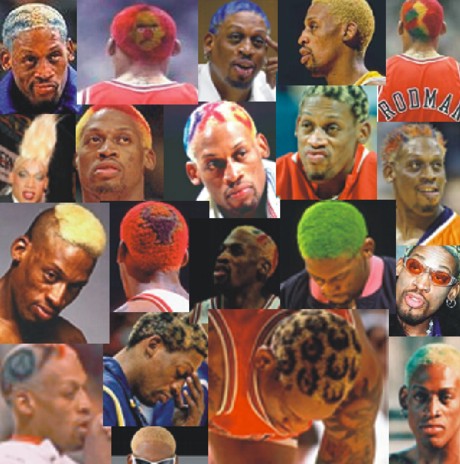

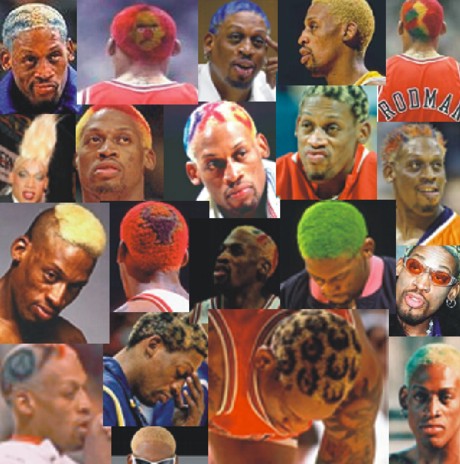

In the parlance of investors there is an oft-expressed and colorful turn-of-phrase, namely, "hair on the deal", that immediately signals the kiss of death for a company's investment prospects. There are of course grammatical and regional variations on this expression but the implication and import are always one and the same: that the company in question will not get funded. Among investors discussing a deal, the mere whiff of this hirsute quality will often suffice to end a discussion of the company's merits and shortcomings. In this post, however, I intend to delve into exactly what the range of characteristics exhibited by a company and/or its founders are that embody this dreaded state of 'hairiness'.

1. Legacy Shareholders:

The fact that a company has legacy shareholders in it is normal. If, however, they exhibit any of the following characteristics, the deal has hair on it.

a) Disgruntled: One or more shareholders is really peeved about something, (doesn't matter what because they'll try to interfere with the deal).

b) Missing: If a number of shareholders can't be tracked down, have moved out of the country and/or are generally unavailable, they will often come back to haunt the company in the future.

c) Too Many: You find out that in his best Max Bialystock imitation, the CEO has something like 50+ individual investors, several of them nonagenarians. Rounding them up will be like herding cats.

2. Unrealistic (Inflated) Valuation:

An example of this would be an angel-backed company touting a $15M pre-money valuation although they do not yet have any customers or revenue to speak of. How receptive do you think they are to a conversation in which you tell them their pre-money is $2M?

3. Irrelevant Founders Who Think They Are Still Relevant:

Sometimes it's time for a founding team to let go and make way for the "next phase". If they can't come to grips with this, the deal has hair on it. (This is a very common situation).

4. Founders Who Suffer From Delusions of Grandeur (Read: Unchecked Egomania):

This treacherous reef has sunk thousands of start-ups. Here the founder cannot deal with the realities of the market and is singularly focused on his/her own destiny as a magnificent and fabulously wealthy hero of some kind. This tragic flaw will color all the important decisions the start-up will have to make.

5. Unscrupulous Broker-Dealers:

I have already written about this common problem in a post entitled Eyes Wide Shut: Welcome to the Masked Ball.

6. Encumbrances (Lawsuits, Disputes, Debts):

If there are lawsuits afoot, disputes among the founders and previous investors (any combination of this), large debts and any other types of serious encumbrances, there is an overgrowth of thick hair on the deal through which no machete will be able to cut.

7. A@#holes:

This type of person of course comes in all shapes and sizes. The appellation can, for example, refer to founders who state their wish for investors' money to pay for a job for their spouse and perhaps a corporate apartment for themselves. It can refer to founders who, although successful in their business, treat their employees like dirt. In a nutshell, it refers to a mercenary, not a missionary.

8. Sloppy Governance:

The diligence process sometimes reveals poor record-keeping, lack of accurate accounting, incomplete documentation. This often signals a deeper mess that requires an archaeological dig to clean-up.

9. Obfuscation and Lack of Transparency:

This too can manifest itself in various kinds of behavior. For example, the founder seems defensive, as if there is something to hide. Their story changes over the course of several conversations. You can never quite get a handle on the financials, the technology or some other vital aspect of the company. I've also posted before about a few different types of white lies often told to investors.

10. Lack of Respect:

If the Founder/CEO is super-critical of others, dismissive of the competition and/or generally treats people poorly, they will most likely not succeed and working with them will be a miserable experience.

I don't pretend that this constitutes a comprehensive list, so by all means, please weigh-in with more and with any juicy anecdotes to bolster your point.

For the next post in this Series, click here.