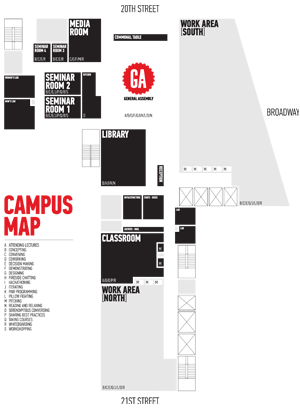

I recently had the pleasure of visiting with John Frankel, founding partner of ff Venture Capital, at their beautiful new NYC headquarters.

Originally from England and with 21 years at Goldman Sachs under his belt John brings an unconventional background to the table as a venture capitalist. Yet his approach is not what one might expect upon hearing this singular detail. I learned, for example, that he's been actively investing in early stage startups (such as Quigo (sold to AOL) and Cornerstone onDemand (now CSOD on NASDAQ) for well over a decade before finally deciding to leave GS and starting his own fund full-time. I also learned that he has a unique (and refreshing) sense of the notion of "risk" in the realm of early-stage investing. Lastly, I learned that he's immensely thoughtful about the macro trends and forces at play in and around the tech space- not surprising from a guy who studied philosophy at Oxford.

Anyway- my favorite line was when he said in a tongue & cheek way that during all those years at the bank he was asking himself what he wanted to do "when he grew up". Looking at ff's formidable portfolio and the amount of fun he's having working with great entrepreneurs who want to change the world- it seems that he's found his calling.

Enjoy!

00:05 Coming to VC from a so-called non-traditional background

01:32 Transitioning from angel investing to full-time venture investing

02:23 John's great and original take on the notion of early-stage investing being "risky"!

03:21 What motivates him as an investor? (Some great stuff here) "A better education than he received at Oxford"... "Working with great entrepreneurs who want to change the world"

04:19 John's take on where things are going and all the "bubble talk" these days

05:50 "We continue to see an unbelievable number of amazing companies"

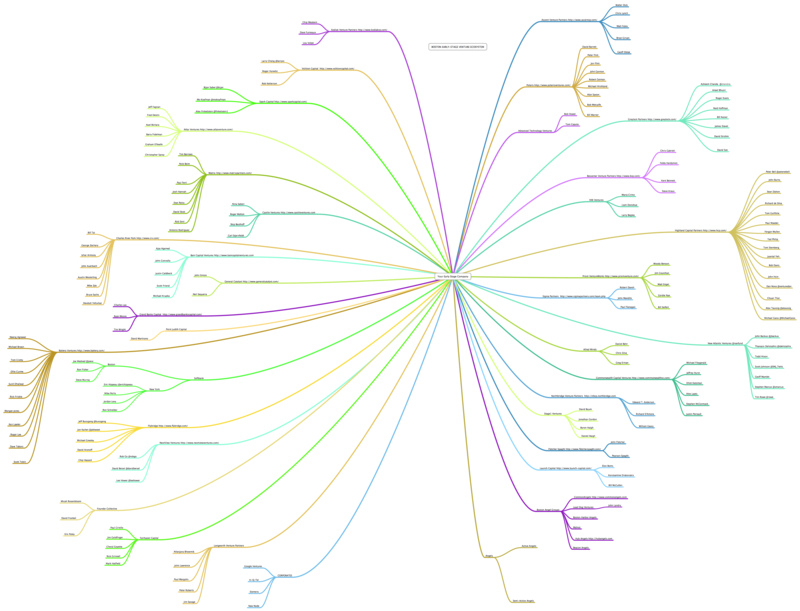

06:22 On getting in touch with @ffventure (warm intros please!)

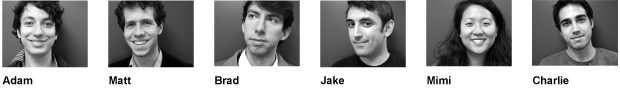

For the full interview click on the image of John just below: