This is Episode (13) of Venture Studio

I sat down recently to speak with with angel investor turned MicroVC, Jeff Clavier, @jeff, founder of SoftTechVC I, II & III on a recent visit of his to NYC. (My thanks to the great people at Polaris Ventures' DogPatch Labs down in Greenwhich Village for hosting our talk.)

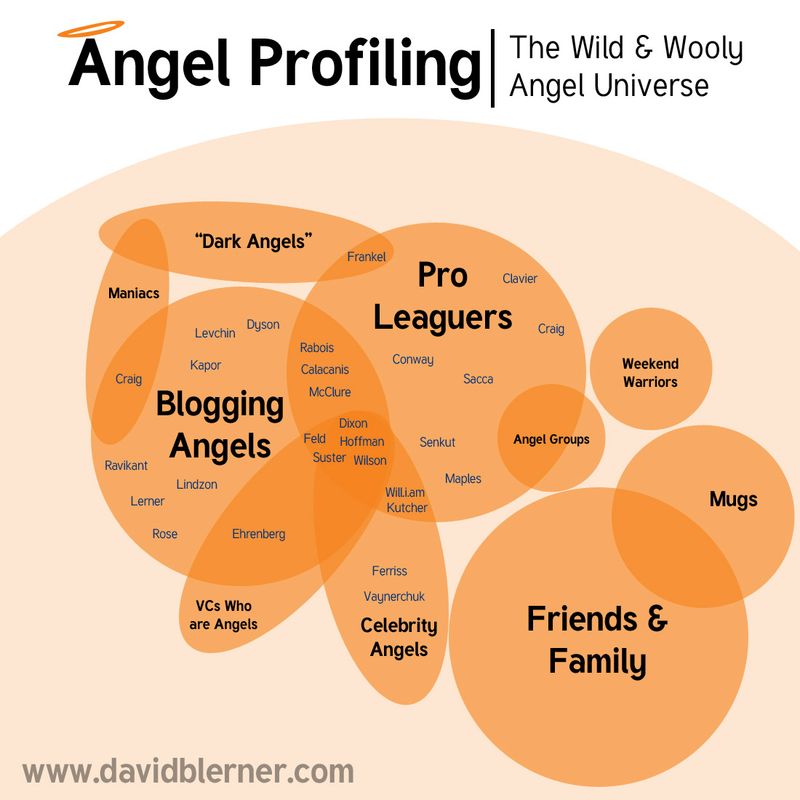

Jeff is a fascinating guy who saw a special opportunity in 2004 to invest in capital-efficient Web 2.0-type companies and got into angel investing in a big way, investing his own money in 20+ companies. He turned out to be enormously gifted at it. Hearkening back to my recent Series on Angel Investing, he most certainly skipped the "Mug" phase that Mark Suster and I have joked about.

He then had the opportunity to raise a small fund and thus became what the press like to call a "Super-Angel"- but what really is more aptly-named, a MicroVC. After 65 investments in this Fund (SoftTech VC II), he has now launched SoftTechVC III, (aka "the real-deal"as he jokingly called it) which will still be a "small" fund, but certainly considerably larger than II.

It was great to hear Jeff's perspective on early-stage investing, the market segments that interest him these days and how he has evolved over the years as an investor. Enjoy.

:26 - A little background on @jeff & how he first got into angel investing

1:19 - Raising his first micro-fund in 2004, which was $15M in size

1:43 - The pioneers in the MicroVC space, including Josh Kopelman

2:23 - On making 65 investments in SoftTechVC II w/10 exits already(!)

3:05 - Launching SoftTechVC III & venture partner Charles Hudson

4:14 - What types of companies/sectors will III be investing in? (See Matrix) Listen carefully here about Jeff's approach to various sectors

6:02 - After 99 investments & reaching this level- what changes in your approach?

7:21 - Epic Line: "In our business there's no pride- we basically do whatever it takes to help our companies"

7:31 - Jeff's perspective on acquisitions (of which he's had 17!) and how he works w/his portfolio company entrepreneurs in this regard

9:01 - Has he noticed network effects amongst his portfolio companies?

9:55 - Jeff invests in a bunch of NYC companies- what are his thoughts on NYC?

11:11 - What are the biggest challenges for him?

12:47 - What's an average day like for Jeff?

SOFTTECH VC III (so far)