Our Startup Genome project got some excellent coverage recently in the Silicon Prarie News. I've appended the text below. It captures what we're trying to accomplish for entrepreneurs and others in the startup ecosystem worldwide.

We've got a burgeoning group of remarkable city and state curators all around the world and we're honored to have Brad Feld of Foundry Group and Startup Revolution join us recently as curator of Colorado. Exciting stuff for sure and more to come soon with new releases.

Feel free to check out Startup Genome to learn more about our mission.

Startup Genome takes local approach categorizing, visualizing ecosystems

OMAHA AUGUST 22, 2012 by SARAH BINDER

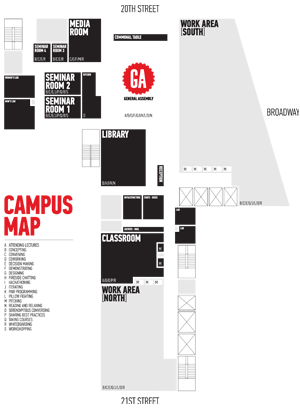

Dave Lerner created maps of the startup ecosystems of New York City (partially shown above, click for full) and Boston. Inspired, Shane Reiser reached out. Today, the two are working to take Startup Genome global.

Ever wished you had a directory of all the startups in your city? All the investors who were interested in technology? Or just the right person to join your team?

Startup Genome, an effort by Shane Reiser of Omaha (far left) and Dave Lerner of New York (near left), aims to put all that information on a map, for every startup hub in the world.

Of course, this isn't a new idea. Startup enthusiasts around the globe have data tucked away in spreadsheets or mapped out on whiteboards. The best-known tools for organizing that sort of information include CrunchBase and AngelList.

Reiser, who also works full time with Kohort, noticed while traveling to different cities organizing Startup Weekend events that homegrown directories weren't easy to share, weren't interconnected, usually weren't up to date and were almost never very visual or interactive.

When he saw that Lerner, an entrepreneur, investor and professor, was making maps of New York City andBoston, Reiser reached out.

The goal, Reiser said: "One place where entrepreneurs can find everything they're looking for in their local community."

Use of local curation is what sets Startup Genome (which is not to be confused with the unrelated Startup Compass tool, the Startup Genome Compass) apart from other databases. While anyone can add to Startup Genome, a team of local curators will monitor and edit the information for their community. For instance, the organizers of StartupIowa announced on Monday that they will curate the Iowa Startup and Entrepreneur Directory.

Reiser's belief in the need for local curation was reaffirmed as he edited Startup Genome data for Omaha. After importing data from CrunchBase, Reiser ended up deleting nearly 60 percent of it — including fake companies, dead companies, individuals who had moved on and companies and individuals who weren't really related to startups. Reiser said Startup Genome started with a list of nearly 150,000 companies nationwide, but that has since been edited down to about 80,000.

Reiser said it will be just as important to keep the wrong information out as it will to get the right information in. Initially, startups, founders, investors and resources will be featured while consultants and service providers will be stripped away. Reiser said those auxiliary services might be added back later.

While Reiser and Lerner started discussing the project months ago, Startup Genome has only been in development for eight weeks. Reiser said the site is currently a minimum viable product. The basics are there — including profiles for people and companies, the ability to search by location and filter results (left) — but a lot of functionality, including AngelList integration and a publicly-available API, is still in the works.

The Startup Genome team also hopes that adding visualizations can make the data more useful and aesthetically pleasing. The first will be a Google Maps layer. The second will be a mind map, which is a type of graph that shows the relationships between data points. For example, if you selected a company on the mind map, you might see employees on one side, investors and mentors on another, and all the companies those people are connected to beyond that. Once the API is available, users will be able to build their own visualizations, too.

Startup Genome is a bootstrapped side project for Reiser and Lerner. While the mission is global, they're keeping an eye on the local.

"We care a lot about the city-based startup community," Reiser said. "We want the city to really own their Startup Genome page, and do what they want with it."

Lerner explains Startup Genome in the video below. For more information, visit the blog.