This is part of my various Series on Entrepreneurial Culture and Mentorship.

I recently wrote this post about the passing of the entrepreneurial giant, John Kluge.

Today I want to share excerpts from this piece in the Columbia Forum that relayed some delightful stories and experiences from John Kluge's life. These priceless anecdotes and pearls of wisdom were originally relayed by Kluge's own son in a piece entitled John Kluge: Stories.

Entrepreneur or not, I am certain you will fund these vignettes enjoyable and perhaps instructive. I know I did.

My stepfather didn’t believe in education.

He wanted me to stop going to school after the eighth grade. That was all the education he thought necessary for a young man. He wanted me to go into the painting business with him. He already had his own children working for him, so I knew I would always be a second-class citizen. I would always be under his thumb. I convinced him to let me go on to high school, at least for one year. And so I skipped part of eighth grade and went straight to high school.

I left home at fourteen.

After my first year of high school, my stepfather still wanted me to quit and join his business. I wanted to get more tools for bettering myself and he didn’t believe in that, so I left home at fourteen.

There was no big scene. I still stayed in contact with my mother, and I never had any dislike for my stepfather. I was never really mad at him, because if it weren’t for him, I wouldn’t have come to this country and I would have been in Hitler’s army.

Over the years, I don’t know whether I was looking for a father, but I had a number of older men who were very generous with their time and advice. I listened to them, and they were good substitutes. Allen Crow was one. Teddy Prentiss was another. Elmer Auden, Judge [Allan] Campbell. These were all men I respected and learned a lot from. But my stepfather, after I finished my first year in high school, said, “No more schooling.” I either had to go into business, or I would have to leave home. I chose to leave home.

I was never afraid of making a decision.

It was an immediate decision, even though I didn’t know where I was going to sleep the first night. I was never afraid of making a decision, regardless of the consequences. For a few days, I slept at the school and washed cars for food money. I waited until after dark so I could shower with the hose. Then I went to the home of one of my teachers, Gracia Gray DaRatt. She taught typing and shorthand in high school, and I took her classes and became quite proficient, which served me well.

James Lin and John Kluge, with three of the Detroit civic leaders who organized their tour of the city. (Lin, center front; Kluge, back, to the right of Lin.)I washed Mrs. DaRatt’s car, and she asked me what I was doing. I said, “Well, I’ve left home,” and I told her why and she took me in. She was a great woman but not someone to make a show. She said, “Here’s the refrigerator, here’s your bedroom, here’s your bathroom,” and that was it.

James Lin and John Kluge, with three of the Detroit civic leaders who organized their tour of the city. (Lin, center front; Kluge, back, to the right of Lin.)I washed Mrs. DaRatt’s car, and she asked me what I was doing. I said, “Well, I’ve left home,” and I told her why and she took me in. She was a great woman but not someone to make a show. She said, “Here’s the refrigerator, here’s your bedroom, here’s your bathroom,” and that was it.

At fourteen, you’re a boy. Between fourteen and eighteen, I became an adult. I grew up very fast. While there was never any pressure, I wanted to be what Mrs. DaRatt wanted me to be, and that was an outstanding student who would go to school beyond high school. She was a remarkable woman, and she encouraged me. She opened up my world. Remember, I was still rather constricted, in every way — in language, in religion, in education. She taught me manners, “the graces.” She even introduced me to American foods, such as the baked potato. Corn. She was a very bright woman but quite pragmatic. Not a lot of warmth on the surface. If I had a cold she wouldn’t say much, you know. She didn’t pamper me at all, and that’s good. She hoped that I would be an independent spirit, which she was. Tough American stock. She was all black and all white, nothing in between, and as you’re growing up that might be a very good influence.

I listened to them and I learned.

I remember Mrs. DaRatt would have people over — doctors, businessmen, judges. I listened to them and I learned. Allan Campbell was a friend of hers. He was a judge, the founding dean of the Detroit City College Law School, and one night Judge Campbell was talking to a realtor about a piece of property he owned. You have to remember this was during the Depression, and the judge was going to lose some money on this property. And I remember this distinctly. The realtor said, “Well, you can do so and so and save some money.” The judge said, “Oh, yes, I can do that legally — but not morally.”

Things like that, these were sign posts to me. It’s not how successful you are. Did you do it without being either a con artist or a person who was so burned up with success that anything goes? I don’t feel comfortable with “anything goes.” Never have, never will.

You know, the teacher said an interesting thing to me once. She said, “John, you’re one of the few people I know who can learn from other people without going through the experience yourself.” I felt that what they said — the judge, all these others — was so important, so meaningful, I could and should apply it to myself. It became important to do that.

Living with Mrs. DaRatt, little by little I formed a conclusion that I wanted to be somebody but not on the basis of cheating or fooling people. It’s been a principle I’ve lived with; I’ve always been much more interested in substance than perception. If the substance is right, I feel that everything is right.

What difference you can make, you should try to make.

In the sands of time, individuals make very little difference. But what little difference you can make, you should try to make. That’s what I’m going to put on my tombstone, because there’s too much avarice in the world, I think. There’s too much competition for things that don’t mean much in the long run. If you make a contribution that makes the world better, not only are you somebody, but you’re implementing. I don’t want to hurt anybody, and I don’t want credit for it. I am not oriented toward getting credit. And so much of that came from the teacher.

In 1953, I was in St. Louis. I’d just closed a deal, buying a radio station in Clayton, Missouri, and I got the news of Mrs. DaRatt’s death. I was the only person at her funeral. It was in the winter time, in Fairhaven, New York, and cold. I had to really take the gravediggers to task, because it was so cold they didn’t want to get out of their hut. I remember so distinctly driving away, and I cried but the tears just froze, it was that cold. Bitter, bitter cold.

She was an inspiration for me. All my life I keep her memory.

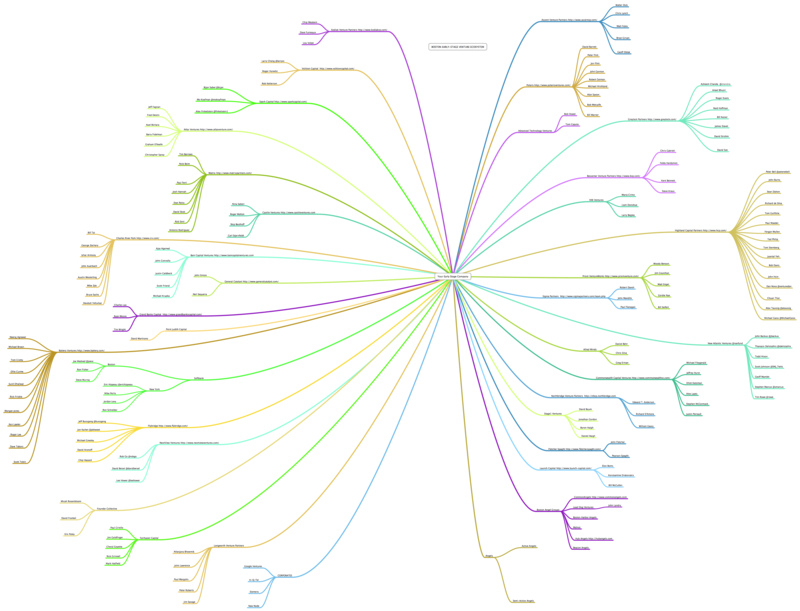

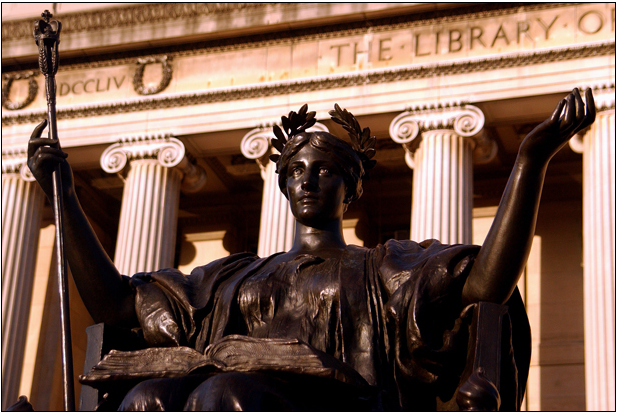

I wanted to go to Columbia because it was in New York.

And not because it was Columbia. I knew I’d need a scholarship so I called Allen B. Crow, who was head of the Detroit Columbia Club.

[The following is Mr. Crow’s recollection of the conversation, many years later.]

I received a phone call at home one evening. The caller asked, “Is this the president of the Columbia Alumni Club?”

I said, “Yes, it is.”

“Do you have a scholarship available?”

“Yes, we do.”

“Well, I want it.”

“Do you have any money at all?”

“No, but I’ll earn the rest. I’m willing to work my way through. But I want your scholarship.”

Well, I admired the boy’s pluck.

“These hands will pull me through.”

I applied for the scholarship and it came down to two fellows: Ed Litchfield and me. Ed was on the debating team, and he was very well-versed in the English language, while I really was not. I wore rough clothes and he was very refined. We both went to Mr. Crow’s house for the interview and I said to Mr. Crow, “I’d like to be interviewed second, if you don’t mind.” So Ed was interviewed first. When Mr. Crow got to me, he asked various questions, the usual things. We were in his sun parlor. Then, as I’m walking to the front door, I turned and walked back. I said, “Mr. Crow, I don’t know whether I’ll get this scholarship, but I want you to look at my hands.” They were very rough because I did a lot of work with my hands. I said, “I don’t know whether I’m going to get this scholarship but even if I don’t, these hands will pull me through.” Well, I think that took Mr. Crow so by surprise.

I still think Litchfield should have gotten the scholarship. But he didn’t get it. I did. Litchfield went to the University of Michigan. You know, he became president of Carnegie Tech at a later time. He was an outstanding fellow, certainly better material than I was.

I had little chance to get the scholarship but I did.

The point is, I always felt that I could work my way through, and I did. I didn’t feel the world owed me anything. As a matter of fact, I consider that, even today, a weakness. The world doesn’t owe anybody anything, because it’s all within yourself. I can’t remember where I ever complained about my life. I always thought my life was wonderful. I really did, even when I didn’t have a penny.

But I can’t understand, even today, why anybody in this country who has his health can complain, because there are always opportunities. If somebody wants to work in this country, they can find work. Oh, sure, it may be cleaning windows, maybe cleaning sewers — whatever — but you can find a job.

When I got the scholarship, I wrote back and said it wasn’t enough.

I was realistic enough to know that I needed an increase for me to go to New York. If they wanted me, they would do that; if they didn’t want me, they’d say no and I would have to live with it. Mrs. DaRatt said, “You know, they’re just going to tell you it’s been nice to have made your acquaintance, but you go somewhere else because you’re too rich for our blood.” But that’s the chance I took.

Well, they gave it to me, but it took a month or so to find out. That schoolteacher, she and I would stop at the post office every day — Box 63 at the Ferndale Post Office — and I would look into that little window for a white envelope with blue printing, and one day there it was. I came out to the car, a little Ford, and I showed the letter to Mrs. DaRatt. She said, “I’ll bet they turned you down.” I said, “I’ll bet they didn’t.” And they didn’t. They gave me the double scholarship.

I learn every day, even now.

Going to school is predominantly to discipline your mind. It’s also to encourage you to go on learning throughout your life. I learn every day, even now. Children have a sense of awe and that’s something we should never lose as adults. The people who have the attitude of knowing everything are sad cases. A scholar knows that when he knows everything, he shuts his mind to anything new.

I think a person needs curiosity, and a sense of enthusiasm. It doesn’t matter what you’re enthusiastic about. To be enthusiastic is to be a participant. It’s a sign you’re alive.

I remember getting ready for Columbia.

Mrs. DaRatt said, “You’ve got to have a tuxedo, and even tails,” and she found some for me. I was standing at the tailor’s as they were downsizing the tuxedo and the tails when I heard one of them say, “Isn’t it too bad that so-and-so died?” So I knew these clothes had belonged to someone who was dead. I could never wear them.

My first roommate was Henry Galbraith [’37] , from El Paso, Texas. I kept telling him, “Henry, you go to dances and all this, you really ought to have a tuxedo and tails.” I finally sold him the whole outfit for twenty dollars: five dollars down, five dollars a month. I didn’t need a tuxedo after all. Beautiful material in it, though. The lining was pink.

I came to Columbia with fifteen dollars, and I left with seven thousand.

To get my scholarship, I had to really work — get all A’s and that sort of stuff. When I went to college I didn’t care. I didn’t care about the Phi Beta Kappa or any of those things, because I had three or four jobs while I was in school and a lot of times I wouldn’t sit down to my studies until midnight. I came to Columbia with fifteen dollars, and I left with seven thousand. I guess I got a B-average. That didn’t bother me. I got what I wanted, and it wouldn’t make any difference what my grades were, as long as they were passing.

I was always selling something.

At graduation they had a cemetery full of headstones for everyone in the class, with quotations on the stones. On my stone they put, “I’m wiser. I sold my body for fertilizer.” I was always selling something.

I was a pricer at the John Jay Dining Hall, so I got my three meals. I had a stationery business. Every freshman who comes in wants to write to his friends, or his girlfriend, or his family, on the stationery of Columbia, with his name or his initials and the year he graduates. Being a pricer at the dining hall, I was able to say to students, “Is this your first year?” Yes. “Have you got any stationery?” He might say no. I’d say, “Give me your room number. I’ll be up to see you.” So being a pricer also gave me a place to sell stationery.

I gave personal service. I brought the stationery to them when it was finished. I did that, also, to collect the money. The printer wanted to get paid right away, so I had to collect the money right away.

Gracia Gray DaRatt with what may be the car Kluge bought for her with his contest winnings.

Gracia Gray DaRatt with what may be the car Kluge bought for her with his contest winnings.

In 1938, the Detroit Times had a contest, and I won second prize — $2,000. That was a lot of money then! I used part of it to buy Mrs. DaRatt a car.

I also cleaned motor rooms in boats on the river. I would work cleaning engine rooms on Saturday and I’d have grease all over me. It took half a day to get rid of the grease. I didn’t want to come up to the Columbia campus with all that grease.

I represented a shoe company, and I would go around the campus with one shoe under my arm. A guy said, “That’s a good-looking shoe,” and I’d say, “Come on up to my room. I’ve got the other one there.” I represented a clothing store on 114th Street, and I got my clothes at a very deep discount.

Nothing really bothered me, because I needed the money to exist. Being a pricer, I got my meals. With the scholarship, I got my room and tuition and books. Any clothing I needed, any other money I needed, I got from the stationery or the odd jobs. And all the ways I raised my money were honest ways.

I was a gambler.

I gambled with sugar heirs from Cuba, anyone who wanted to play. One day the dean of Columbia College asked me to come to his office. He said, “You know, we don’t understand you. You’re gambling all night and you’re here on that scholarship.” I said, “Dean, you’ll never catch me gambling again.” That’s the first time I realized the dean of Columbia College didn’t understand the English language. I didn’t say I wouldn’t gamble again, I said he’d never catch me again.

I remember playing stud poker and five card, with the first card down and the next four up. One night I had a five up and the next card was a five. The two after that didn’t mean much but the third card was a five — three fives. Just as the betting was really getting hot, there was a knock on the door. We had all agreed that as soon as there’s a knock, all of the cards will go under the table and be cancelled out. So the cards went away and I opened up a book. The door opened and believe it or not, it was a guy who had a headache and wanted some aspirin. I never knew that a headache could be transferred that quickly. So ever since, there have been three fives always landing in my mind.

When I bought the DuMont television stations, they had a Channel 5 in New York and they had a Channel 5 in Washington. I went up to Boston to buy their Channel 5, and I borrowed the money, two hundred and twenty-two million. I said, “You’ve got a week to decide,” because I didn’t want them to shop the station and run up the price. And that’s how I got the three fives together for Metromedia.

They took my appendix out for no reason.

My roommate introduced me to beer. I was pretty woozy from that first drink. We came back to the dormitory and I went to the lavatory — there was just one common one on each floor. Well, I looked in the bowl and there was blood. I ran down to our rooms and I said to my roommate, “I’m dying!”

We went directly to St. Luke’s Hospital and they took my appendix out. I was there ten days and when I came back, we had a powwow on the floor. This one fellow asked me, “Why did you go to the hospital?”

I said, “I was bleeding, the night of so-and-so.”

He took me down to the lavatory and he said, “Which stall?” I showed him. He said, “That’s the night I had a nosebleed.” They took my appendix out for no reason. But while I was there, I met a very nice young woman, a nurse there, and we went out for some time. So something good came out of it.

“Outstanding people want to be with outstanding people.”

Columbia, I think, is a great institution. Nicholas Murray Butler [Class of 1882] was president of the university while I was there — both before and after, until the 1940s. One time, I asked him, “Dr. Butler, how is it you’re able to keep some of these professors here?” He said, “I’m going to tell you. Outstanding people want to be with outstanding people. They don’t want to be alone. It doesn’t stimulate them.” I think he’s right, and Columbia’s had some great people.

When you have nothing, why not take a risk?

There was a professor, Armin K. Lobeck, and he was in geology. He mesmerized me, my second year at Columbia. He made geology so interesting, I thought I would become a geologist — specifically, a paleontologist —and would probably work for an oil company, traveling the world. But in my third year and then, reinforced by my fourth year, I thought it over and I decided I wanted to go into business. I think basically I always wanted to go into business, but this geology course was so interesting, Professor Lobeck made it so interesting, that I darned near changed my mind. If I’d gone in that direction, I can tell you one thing — I would have been a wildcatter. My instincts are always to take a risk. I like taking risks. I guess it’s like an addiction. My addiction is taking a risk. When you have nothing, why not take a risk? You can only fall on your face.

I know this sounds crazy, but I don’t really like a sure thing. It doesn’t give me any excitement. As I got older, the risks became more calculating. I felt they would be worthwhile, they would succeed, and it often turned out that way.

And though I like risks, I don’t go into them unprepared. I think about them a lot, and I try to read as much as I can. I’m an information junkie, a news junkie. I paid nine dollars once for a New York Times in Iran. I gather information and I consult with my people but then I have to make that decision.

Most often, I make it on the basis of — will we add something to this business? I am oriented to improving a product or service. Just me-too business, that’s not interesting to me. Every business I’ve ever been in, my thoughts were always to improve what they’re doing. It might not be successful, but I love taking a risk. I really don’t like a sure thing. That doesn’t give me any thrills.

© 2009 Winterhouse

The photographs that accompany this piece are drawn from the papers of John W. Kluge ’37, held by the Kluge Center at the Library of Congress.