This is Episode (10) of Venture Studio

Welcome to this week's conversation with Ben Lerer, CEO of Thrillist, which he started five years ago in NYC as a daily email/city guide chock full of product and experiential recommendations for a very underserved market- urban-dwelling guys. Since then, Ben and his team have scaled the company to over three million subcribers, 90+ employees and into approximately 20 cities around the country. They have also just made their first acquisition: JackThreads and have launched a Rewards program.

I would say that "evolution" was definitely one of the major themes of our talk. Ben talks not only about the evolution of his business but also of his own from a "do everything kind of entrepreneur" to a guy who now oversees a large and growing business with talented people in important roles. It's a transition that any startup entrepreneur should aspire to make one day.

We also discuss Lerer Ventures, (the seed investment fund he and his father operate). Here too we talk about his evolution as a seed investor. Enjoy.

:20 - What is the story of Thrillist and how it got started?

2:10 - On getting funded by AOL veteran Bob Pittman of the Pilot Group

3:34 - What's an average day like for Ben lately?

4:04 - "Thrillist is definitely hiring!"

4:35 - How has Ben's role at Thrillist evolved as the company has scaled?

5:13 - What's with the Bowie Knife? (ok, ok, it's plastic....)

8:19 - Biggest lessons learned... (it's that focus thing again!)

10:04 - All about the JackThreads acquisition

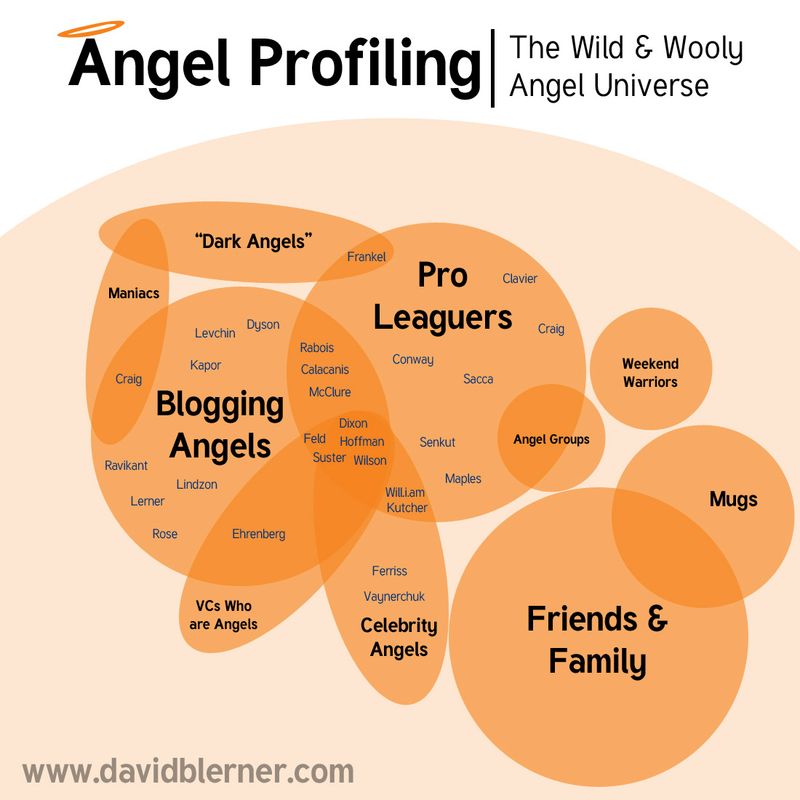

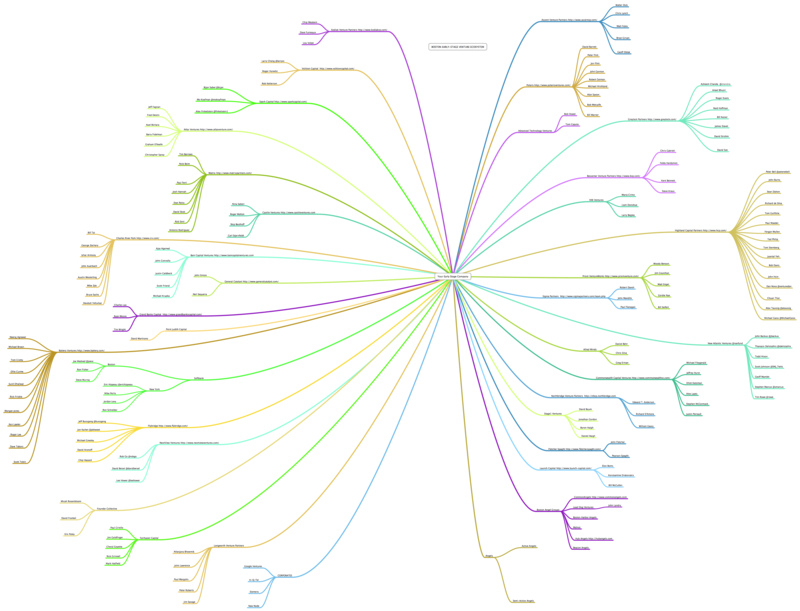

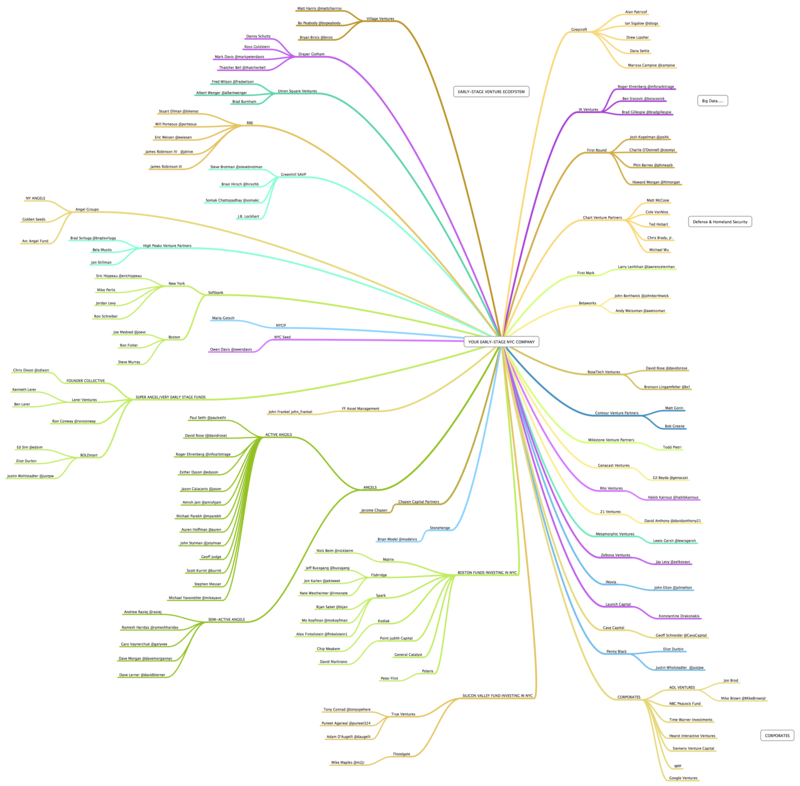

11:40 - Lerer Ventures & their evolution as seed-stage investors

14:24 - What are they looking for in terms of entrepreneurs they back?

15:02 - What is the Rewards Program and what's next for Thrillist?

Click Here for Venture Studio (11) w/ Jonathan Glick from Sulia